State Guides

Guide to Forming an LLC in Georgia

Follow our free guide to form an LLC in Georgia

- Pros and Cons of Forming an LLC in Georgia

- Starting Your Georgia LLC

- Maintaining Your Georgia LLC

- Additional Georgia Resources

Should you form your LLC in Georgia? We’ve collected the relevant information that will help you make this decision.

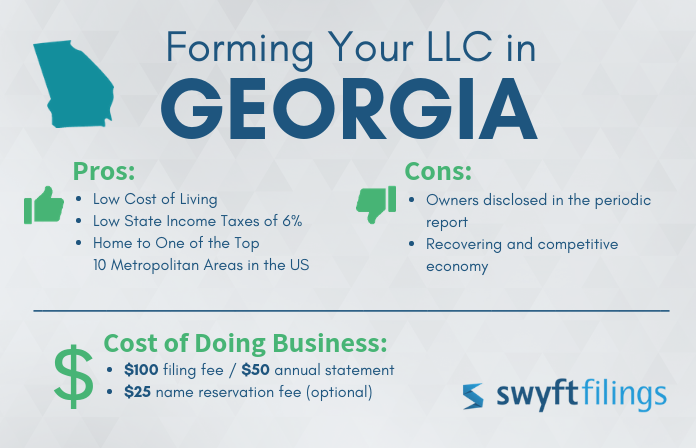

Pros and Cons of Forming an LLC in Georgia

Pros

Low Cost of Living

Like most states, prices of homes vary with location. The average price of a home in the larger cities of Georgia ranges anywhere from $114,000 to $420,000. However, renting in Georgia is well below the U.S. average, with one-bedrooms averaging $908 and three-bedrooms around $1,176 per month. Gas prices are 5% under the national average, and food and groceries are close to 1% above average.

Low State Income Taxes of 6%

The tax bracket in Georgia ranges from 1% to only 6%, depending on income. Incomes over $7,000 automatically pay a 6% tax rate, which is almost 2% less than the average national state income tax. This is significantly lower compared to California’s income tax rate of 13.3%.

Home to One of the Top 10 Metropolitan Areas in the US

According to the U.S. Census Bureau, Atlanta, Georgia has the #3 largest-gaining metropolitan area, and the #8 most populous metropolitan area in the U.S., with 5,789,700 residents. A larger population yields opportunity for growth in any company, both in employees of the company and customers.

Cons

Recovering and Competitive Economy

Since the recession, Georgia’s economy recovered slower than most states in the country. From 2004 to 2014, the economy only grew 0.9%, and 2015 on grew close to or higher than 2.7% year over year. The income is significantly lower than the national average, at $38,980.

High Crime Rate in Atlanta

Two reports in 2016 listed Atlanta as one of the more dangerous cities in the nation, particularly because of its violent crime/murder stats - more than three times the national average in 2016. Only a few years ago, Atlanta was ranked as one of the top 25 “murder capitals” in the U.S.

Poor Air Quality Scores

In a recent report released by the American Lung Association, several Georgia counties received failing grades on air quality. Notably, Fulton county (home to Atlanta) garnered an “F” for its smog rating. Atlanta’s poor air quality has been called a contributing factor in the city’s higher-than-normal crime rating.

Cost of Doing Business

- $100 filing fee / $50 annual statement

- $25 name reservation fee (optional)

Phase One: Starting Your Georgia LLC

Although there is an in-depth procedure for filing a business, Swyft Filings provides a comprehensive guide that walks aspiring business owners through the process. Start your LLC in Georgia today by following these six simple steps:

- Step 1: Name Your Georgia LLC

- Step 2: Establish Ownership

- Step 3: Find a Registered Agent in Georgia

- Step 4: File the Articles of Organization

- Step 5: Create an LLC Operating Agreement

- Step 6: Obtain an EIN

Step 1: Name Your Georgia LLC

The first step involved in forming your Georgia LLC is choosing a name your business. Be sure to check out the state and federal guidelines concerning the use of certain words in business names.

Tip: Use a free business name search tool to ensure your company’s desired name is available.

Business Name Guidelines

- The official name of your business must end with: Limited Liability Company, Limited Company, LLC, or L.L.C.

- Your business name cannot be intentionally misleading to consumers

- The name of your new LLC must not be similar to another organization’s name/trademark

Restrictions

- “Lottery” and “Bank” are ineligible for use (any state)

- Terms that represent educational or Veterans’ organizations are restricted

- Terms related to the Armed Forces or civil servants (police, EMT, fire)

LLC business names associated with government and/or financial entities are not always restricted - it depends on the state. Additional paperwork may be required.

URL Availability

You also need to check domain name availability for your company’s website at a number of online web services sites.

Step 2: Establish Ownership

LLC owners are actually known as members and/or managers. All LLCs will have members, but not every LLC will have managers — the difference depends on the elected management structure of the business.

LLC Management Structures:

- Member-managed: All members participate in operating and making decisions for the LLC

- Manager-managed: An appointed manager oversees the daily operations of the LLC and the members are not actively involved.

Georgia LLC Member Guidelines

Required Number of Members

There must be at least one member or manager to form an LLC in Georgia.

Member Disclosure Requirements

An organizer/authorized representative may sign and file the Articles of Organization in place of the LLC members.

Age Restrictions

LLC members in Georgia may be of any age.

Residence Restrictions

There are no residency restrictions imposed on LLC members in Georgia.

Step 3: Find a Registered Agent in Georgia

All Georgia LLCs are required to select a registered agent. In fact, your LLC will not be officially formed without this position.

What is a registered agent?

A registered agent is a person or business who receives all official government mail and service of process notices on behalf of the LLC.

Why do you need a registered agent?

Georgia law requires all businesses to appoint a registered agent so that the state government has a consistent contact person at all times.

What are the main requirements for a registered agent?

- The registered agent has a physical address — not a P.O. Box

- The registered agent is available during standard business hours

Who can be a registered agent in Georgia?

- A Georgia resident with a physical address

- An LLC or corporation that is licensed to conduct business in Georgia

Can I be my own registered agent for my business?

You are legally allowed to be your own registered agent as long as you have a physical address in Georgia.

Is being my own registered agent discouraged?

Since the registered agent’s name and address are publicly listed, LLC business owners who choose to be their own registered agent risk compromising their personal information.

Tip: Avoid the hassles and choose Swyft Filings to fill the registered agent needs for small businesses in Georgia. Find more information here.

Step 4: File the Articles of Organization

The most important step — officially forming your Georgia LLC revolves around filing the Articles of Organization with the Secretary of State.

What is the Articles of Organization?

The Articles of Organization is a legally binding document that is filed with the state government to legally form your LLC.

Why do I need the Articles of Organization?

Your Georgia LLC will not be legally recognized by the Secretary of State without this document. Consider the Articles of Organization as part of your LLC’s foundation.

What information is included in the Articles of Organization?

- The name and address of the LLC

- The contact information of the organizer filing the paperwork

- The name and location of the registered agent

Additional Georgia Filing Information — Professional Service Businesses

Georgia does not allow professional service businesses to form LLCs; these types of businesses must form a corporation in order to operate in state borders.

Form your LLC with Swyft FIlings and we’ll file the Articles of Organization for you.

Step 5: Create an LLC Operating Agreement

Although not mandatory to have an LLC operating agreement, it is highly recommended to have one present. The operating agreement also shows professionalism and helps prevent creditors from getting to your personal assets.

What is an LLC Operating Agreement?

The LLC Operating Agreement is a legal document that defines operating procedures through the roles of the members/managers and explains the voting rights and asset distribution of each person.

Why do I need an LLC Operating Agreement?

Because the LLC Operating Agreement defines the roles of the business’s members and provides direction for daily operations, the document ensures stability and structure to the LLC and reduces future disputes.

Do I need to file the LLC Operating Agreement?

You do not need to file the Operating Agreement with the state; it is for the benefit of your LLC and remains in-house.

What goes into an LLC Operating Agreement?

While there is not a set rule of what must be included in your LLC Operating Agreement, most documents include the following information:

- List of the members/managers and their roles

- Designation of authority in the LLC

- Initial capital contributions of the members

- Voting designations and percentages of the members

- Member transfer/addition rules and restrictions

- Distribution of profits

- Meeting schedule

Tip: Get a customized LLC Operating Agreement for your small business with Swyft Filings. Add structure to your LLC now.

Step 6: Obtain an EIN

Most Georgia businesses are required to obtain an EIN. Your Georgia LLC will not be able to conduct business without this ID.

What is an EIN?

The EIN (Employer Identification Number) is a nine-digit number that the IRS assigns to your business for identification purposes. The EIN is similar to a personal Social Security number.

Are all businesses required to have an EIN?

Federal law dictates that certain types of business entities register for an EIN:

- Any business with employees (even if owned by one person)

- Any business with more than one member

- A partnership (LLC or C-corp)

Please Note: A sole proprietorship is not required to have an EIN, but it is still recommended.

Why does my LLC business need an EIN?

The more common reasons you would need an EIN are:

- To hire employees

- To open a bank account in the U.S.

- To file your company’s taxes

- To pay independent contractors

In short, if you make money through your business and it has employees, you must have an EIN.

Is the EIN publicly listed?

The EIN for your LLC will be part of public record.

Can I use my Social Security Number as the EIN?

If you are a sole proprietorship who wants an EIN for your business, you can elect to use your social security number; however, your EIN is part of public record.

Swyft Filings offers EIN services for small businesses in Georgia. Find more information here.

Phase Two: Maintaining Your Georgia LLC

In order to stay compliant with the state of Georgia, LLC owners must follow the protocol pertaining to the state. The procedure includes:

- Step 1: Register for Georgia State Taxes

- Step 2: Obtain Business Licenses and Permits

- Step 3: Complete Annual Registration

- Step 4: Obtain a Certificate of Existence

Step 1: Register for Georgia State Taxes

Georgia does not charge LLCs any corporate or franchise taxes. LLC members are still required to pay state and federal income taxes on their earnings.

State Income Taxes

Georgia’s state income tax rate is 6% for all income above $7,000. Recent amendments by the state legislature have changed the rate to 5.75% in 2019, and then 5.5% in 2020.

Corporate Tax Information

You can also choose to have your LLC taxed as a corporation; if so, you will be responsible for paying the corporate income tax rate of 6% on your business’s earnings.

Please Note: Recent changes to tax laws by the state legislature will lower the rate to 5.75% in 2019, and then to 5.5% in 2020.

Companies with a net worth that exceeds $100,000 will also be responsible for the net worth tax in addition to the corporate tax. Tax fees begin at $125 ($100,000 to $150,000) and cap out at $5,000 ($22 million and up).

Additional Tax Information

Other taxes your LLC may need to pay:

- Sales and Use Tax at 4%

- Employee Withholding Tax

- Unemployment Tax

Step 2: Obtain Business Licenses and Permits

The business licenses and permits required in Georgia vary wildly depending on the county or municipality where your new LLC is located. If you have multiple locations for your business, you may need to register each location and pay the allotted fees. Additionally, specialized licensing is required for certain businesses such as medical institutions and contractors.

A few common permits in Georgia include:

- Business licenses/tax permits

- Regulatory permits, such as health and alarm permits

- Building and signs permits

If you would like to see more in-depth information on licenses and permits, please feel free to visit the content in our learning library that covers business licenses and permits.

Step 3: Complete Annual Registration

All businesses formed in Georgia are required to complete annual registration with the Secretary of State.

What is an annual registration?

Annual registration, which is also known as an annual report, is legal documentation that is filed with the Secretary of State to keep your business’s information current with the state.

What kind of information is in the annual registration?

The information requested in the annual registration is similar to what was listed in the Articles of Organization:

- The name and address of the business

- The name and address of the registered agent

- The names of the members

- The business’s EIN

Is the annual registration part of public record?

The annual registration filed on behalf of your LLC is a matter of public record.

Fees and Due Date

Fee: $50

Due Date: Jan 1 - April 1

Implications of Late Filings: $25 late fee and eventual LLC dissolution

Please Note: Georgia LLCs are not required to submit the annual registration until the year following official formation.

Swyft Filings helps you stay compliant by providing stress-free solutions. File your annual report with us today.

Step 4: Obtain a Certificate of Existence

The Certificate of Existence, also known as Certificate of Good Standing, is used when banks and other businesses want to verify that your LLC is fully compliant.

What is a Certificate of Existence?

The Certificate of Existence is an official notification that confirms your business is properly formed and is in good standing with all state regulations.

Who issues the Certificate of Existence?

The Certificate of Existence is generally issued by the Secretary of State.

When can I request a Certificate of Existence for my business?

You will be able to request a Certificate of Existence after your LLC is officially formed through the Secretary of State.

Why do I need a Certificate of Existence?

Many businesses and financial institutions want proof that your LLC is compliant with the state government. Some companies may not even agree to conduct business if your LLC does not have this certification.

Additionally, some states require a Certificate of Existence before a business can apply for Foreign Qualification.

Does the Certificate of Existence have an expiration date?

The Certificate of Existence does not expire/does not need to be renewed.

Swyft Filings can create a Certificate of Existence for your Georgia LLC. Click here for more information.