State Guides

Guide to Forming an LLC in Hawaii

Follow our free guide to form an LLC in Hawaii

- Pros and Cons of Forming an LLC in Hawaii

- Starting Your Hawaii LLC

- Maintaining Your Hawaii LLC

- Additional Hawaii Resources

Hawaii is more than a tourist’s paradise - our comprehensive guide on forming an LLC in Hawaii gives you all of the information you need to decide how to chart your LLC’s course.

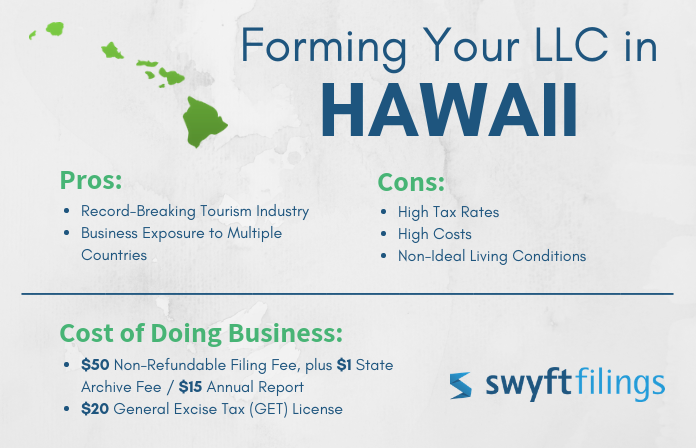

Pros and Cons of Forming an LLC in Hawaii

Pros

Record-Breaking Tourism Industry

According to the president and CEO of Hawaii Tourism Authority, the Hawaii tourism industry achieved $16.78 billion in visitor spending, $1.96 billion in generated tax revenue, 9.38 million visitor arrivals, and supported 204,000 jobs statewide in 2017.

Business Exposure to Multiple Countries

Hawaii’s location opens the opportunity for business in the Asia-Pacific region as well as the United States. The USAPC (United States Asia Pacific Council) headquarters are in Honolulu. Although closest to California, Hawaii is also a reasonable distance away from major manufacturing countries like China and Japan.

Cons

High Tax Rates

Hawaii has the second-highest individual income tax rate in the country, at 1.4-11% based on income. Hawaii does not have a sales tax, but they impose the GET (General Excise Tax) at 4-4.5%, which is imposed on all business activities including rental income, commissions, retail sales, services, etc.

High Costs

Hawaii’s high cost of living can mostly be attributed to its isolated location — far enough from the mainland to make Hawaii one of the most expensive states to call home. The median home price in Oahu is now an astonishing $730,000, and the price of electricity is over 200% higher than other states. Even toilet paper is expensive with an average of $6 for four rolls.

Non-Ideal Living Conditions

The living conditions in Hawaii are costly for locals, and those who own a business. Weather is unpredictable, and prone to hurricanes, tropical storms, and flash flooding. In addition to the high costs that accompany natural disasters, island infrastructure takes up a large part of the city’s budget and focus, limiting help to businesses in need.

Cost of Doing Business

- $50 Filing Fee, plus $1 State Archive Fee

- $15 Annual Report

- No corporate/franchise tax

Phase One: Starting Your Hawaii LLC

Starting a business in Hawaii can be done in six simple steps. The process is not that difficult when you have assistance. Here are the steps needed to ensure that your Hawaii LLC comes together correctly:

- Step 1: Name your LLC

- Step 2: Establish Ownership of your LLC

- Step 3: Decide on a Registered Agent

- Step 4: File the Articles of Organization

- Step 5: Create your Operating Agreement

- Step 6: Register for an EIN

Step 1: Name Your Hawaii LLC

The most important step in forming your Hawaii LLC is to choose a business name. There are some guidelines set by the state and federal government concerning business names.

Tip: Use a free business name search tool to ensure your company’s desired name is available.

Naming Guidelines

The first step of filing an LLC in Hawaii is choosing a unique business name. Before you solidify a name, there are a few guidelines to keep in mind:

- The official name of your business must end with: Limited Liability Company, Limited Company, LLC, or L.L.C

- Your business name cannot be intentionally misleading to consumers

- The name of your new LLC must not be similar to another organization’s name/trademark

Restrictions

In addition to the guidelines for your LLC name, there are also certain terms that are restricted or require additional paperwork to file.

If you file with any of the following terms, you might be rejected by the state:

- “Lottery” and “Bank” are ineligible for use (any state)

- Terms that represent educational or Veterans’ organizations are restricted

- Terms related to the Armed Forces or civil servants (police, EMT, fire)

LLC business names associated with government and/or financial entities are not always restricted, but additional paperwork may be required.

URL Availability

In this technological age, it is very important to create an online presence for your business. You can easily check domain name availability at a number of online web services sites.

Step 2: Establish Ownership

Depending on the management structure of the business, the owners of an LLC are referred to as members and managers rather than owners. All LLCs will have members, but not all LLCs will have managers.

Owners of an LLC must define which management structure they would like to designate in their company. LLCs generally have two management structures:

- Member-managed (ownership of business is divided among the members and all parties receive portions of the profits)

- Manager-managed (the appointed manager is the main operator and the members are passive investors who are not actively involved in the daily business operations)

After you have selected a name for your business, you then need to choose a management structure and designate the members of the LLC. The rules concerning LLC ownership in Hawaii include:

Required Number of Members

Hawaii requires one (1) or more members to start an LLC.

Member Disclosure Requirements

Hawaii state law requires the LLC members/manager to be listed in the Articles of Organization.

Age Restrictions

There is currently no age requirement to form an LLC in Hawaii.

Residence Restrictions

There are no residency restrictions imposed on LLC members in Hawaii.

Step 3: Find a Registered Agent in Hawaii

It is necessary for all LLCs formed in Hawaii to have a registered agent. Without a registered agent, your business cannot be official.

What is a registered agent?

A registered agent is a person or business who is authorized to accept official government notices (such as the service of process) on behalf of the LLC.

Why do you need a registered agent?

Hawaii law requires you to appoint a registered agent so that the state government has a consistent contact person for your LLC.

What are the main requirements for a registered agent?

- The registered agent must have a physical address — not a P.O. Box

- The registered agent must be available during business hours

Who can be a registered agent in Hawaii?

The requirements to be a registered agent are as follows:

- A state resident with a physical address in Hawaii

- An LLC or corporation that is licensed to conduct business in Hawaii

Is the registered agent’s contact information publicly accessible?

The name and contact information of the LLC’s registered agent is a matter of public record.

Can I be my own registered agent for my business?

The state of Hawaii legally allows business owners to be their own registered agents as long as they have a physical address in Hawaii.

Is being my own registered agent discouraged?

Since the registered agent’s name and address are publicly listed, LLC business owners who choose to be their own registered agent risk compromising their personal information.

Tip: Avoid the hassles and choose Swyft Filings to fill the registered agent needs for small businesses in Hawaii. Find more information here.

Step 4: File the Articles of Organization

The Articles of Organization is the legal document required to register an LLC in Hawaii.

What is the Articles of Organization?

The Articles of Organization is a legally binding document that officially and legally forms your LLC as it is filed with the state government.

Why do I need the Articles of Organization?

Since the Articles of Organization are a part of your LLCs foundation, your LLC business in Hawaii will not be legally recognized by the Secretary of State without filing this document.

What is the cost of filing the Articles of Organization?

The filing fee for Hawaii is $50.

What information is included in the Articles of Organization?

- The name and address of the LLC

- The names of the members/managers of the LLC

- The name(s) of the organizer — if applicable

- The name and location of the registered agent

- The chosen LLC management structure

- The duration of the LLC

Additional Hawaii Filing Requirements

For the period of duration, you may select “At-will” if you do not have a set closure date. The date of registration will be the date that the Articles of Organization is filed. All filing fees are non-refundable.

Step 5: Create an LLC Operating Agreement

While an Operating Agreement does not need to be included in the filing documents, this agreement is still considered a vital necessity for any successful business to determine the structure of your company.

What is an LLC Operating Agreement?

The LLC Operating Agreement is an agreement between the members of the LLC that establishes how the operations and finances will function.

Why do I need an LLC Operating Agreement?

Because the LLC Operating Agreement defines the roles of the business’s members and provides direction for daily operations, the document ensures stability and structure to the LLC and reduces future disputes.

Do I need to file the LLC Operating Agreement?

The LLC Operating Agreement remains in-house for the benefit of your company and does not need to be filed with the state.

What goes into an LLC Operating Agreement?

While there is not a set rule of what must be included in your LLC operating Agreement, most documents include the following the information:

- Designation of the members/managers

- Initial capital contributions of the members

- Voting designations and percentages

- Member transfer/addition rules and restrictions

- Distribution of profits

Tip: Get a customized LLC Operating Agreement for your small business with Swyft Filings. Add structure to your LLC now.

Step 6: Obtain an EIN

The state of Hawaii requires an EIN for any business that has/will have employees. Additionally, most banks and financial institutions require the EIN to open any accounts.

What is an EIN?

Much like a personal Social Security number, the EIN is a nine-digit number assigned to your business by the Internal Revenue Service (IRS) to help identify your business with the government.

What does EIN stand for?

EIN is an acronym for Employer Identification Number. It is also known as a Federal Tax ID.

Are all businesses required to have an EIN?

The types of business entities that need an EIN include:

- LLcs with employees (even if owned by one person)

- LLCs with more than one member

- Partnerships (LLC or C-corp)

Please Note: A sole proprietorship is the only business entity that is not required to have an EIN.

Why does my LLC business need an EIN?

The more common reasons you would need an EIN are:

- Hiring employees

- Opening a bank account in the U.S.

- Filing your company’s taxes

- Paying independent contractors

In short, if you make money through your business and it has employees, you must have an EIN.

Is the EIN publicly listed?

The EIN for your LLC will be part of public record.

Can I use my Social Security Number as the EIN?

If you are a sole proprietorship who wants an EIN for your business, you can elect to use your social security number; however, your EIN is part of public record.

Swyft Filings offers EIN services for small businesses in Hawaii. Find more information here.

Phase Two: Maintaining Your Hawaii LLC

Now that you have officially filed your Hawaii LLC, there are still steps to maintain the company’s compliance with government regulations. The next few steps are:

- Step 1: Register for Taxes in Hawaii

- Step 2: Apply for Permits and Licenses

- Step 3: File the Annual Report

- Step 4: Request a Certificate of Good Standing

Step 1: Register for Hawaii State Taxes

Hawaii does not charge LLCs with a corporate or franchise tax. LLC members are still required to pay state and federal income taxes on their earnings.

State Income Taxes

Hawaii’s state income tax rates are listed in the table below:

Corporate Tax Information

You can also choose to have your LLC taxed as a corporation; if so, you will be responsible for paying the corporate income tax rate on your business’s earnings. Hawaii’s corporate tax rate information is below:

Salary Range | Tax Rate |

$0 — $25,000 | 4.4% |

$25,001 — $100,000 | 5.4% |

Over $100,000 | 6.4% |

Additional Tax Information

Other taxes your LLC may need to pay:

- 4% — 4.5% General Excise Tax

- Employee Withholding Tax

- Unemployment Tax

Step 2: Obtain Business Licenses and Permits

The licenses and permits required for an LLC in Hawaii can vary, depending on a number of variables:

- Location (city and county)

- Type of Business

- Industry

Tip: If you would like to see more in-depth information on licenses and permits, please feel free to visit the content in our learning library that covers business licenses and permits.

Step 3: File an Annual Report

LLCs formed in Hawaii are required to file an annual report with the Department of State. The purpose of the annual report is to keep your business’s information and status updated with the state.

What is an annual report?

An annual report, which is also called a periodic report, is a legal form that is filed with the Secretary of State on a periodic basis that is designed to keep your business’s information current with the state.

What kind of information is in the annual report?

The information requested in the annual report is similar to what is in the Articles of Organization:

- The name and address of the business

- The name and address of the registered agent

- The business’s EIN

Is the annual report part of public record?

The annual report filed on behalf of your LLC is a matter of public record.

Fees and Due Date

Fee: $15

Due Date: All filings are due by the end of the quarter in which the LLC was originally filed. Quarter-end dates are:

- March 31

- June 30

- September 30

- December 31

Frequency: every year

Implications of Late Filings: Late filings will incur a $10 late fee annually.

Swyft Filings helps you stay compliant by providing stress-free solutions. File your annual report with us today.

Step 4: Request a Certificate of Good Standing

The final document you need to start your Hawaii LLC is the Certificate of Good Standing, which is an essential part of business verification.

What is a Certificate of Good Standing?

The Certificate of Good Standing is an official statement from the government agency that confirms your entity has met all the necessary requirements including fee payments, annual report, and taxes to conduct business in Hawaii.

Who issues the Certificate of Good Standing?

The Certificate of Good Standing is generally issued by the Secretary of State.

When can I request a Certificate of Good Standing for my business?

A Certificate of Good Standing can be requested for your business once it is officially formed through the Secretary of State.

Why do I need a Certificate of Good Standing?

The Certificate of Good Standing is necessary for due diligence when you need to renew specific licenses, move the business across state lines, verify bank or financial information, and even sell a business.

Additionally, some states may require a Certificate of Good Standing before a business can apply for Foreign Qualification.

Does the Certificate of Good Standing have an expiration date?

The Certificate of Good Standing does not expire/does not need to be renewed.

Swyft Filings can create a Certificate of Good Standing for your Hawaii LLC. Click here for more information.