State Guides

Guide to Forming an LLC in North Dakota

Follow our free guide to form an LLC in North Dakota

- Pros and Cons of Forming an LLC in North Dakota

- Starting Your North Dakota LLC

- Maintaining Your North Dakota LLC

- Additional North Dakota Resources

The LLC formation process in North Dakota has multiple steps; however, our comprehensive guide breaks down the whole experience into two phases to help you better understand how to start your own LLC.

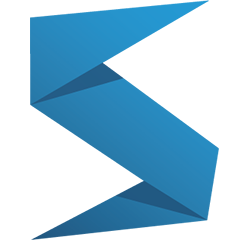

Pros and Cons of Forming an LLC in North Dakota

Pros

Among the Top States for Business

North Dakota has consistently found itself ranked among the top ten US states for small businesses — the reasons include low taxes, low cost of doing business, and ample access to financing. Fortune touts North Dakota as having the largest number of new business formations in the last year.

No Corporate/Franchise Taxes

North Dakota does not impose any corporate or franchise tax on LLCs. The only taxes owed on the LLC’s revenue is the personal income tax paid by the members.

Low State Income Taxes

North Dakota’s state income tax rates are among the lowest in the country, with the highest percentage on the scale at a very low 2.9% — most residents pay between 1.1% and 2.04%.

Cons

Less Privacy for Owners

North Dakota requires the LLC members/managers to be listed in the annual report.

Sparse Population

North Dakota ranks 47th for population density. Although some might say that a small population in certain areas may boost the quality of life, this might be more difficult for small businesses that need to reach a dense customer base. Larger communities would better-serve businesses, especially brick-and-mortar.

Cost of Doing Business

- $135 filing fee/$50 annual report

- No corporate/franchise tax

Phase One: Starting Your North Dakota LLC

Starting an LLC in North Dakota is not as difficult as you may think — there is much less stress involved when you know how to proceed. Begin the process of setting up your LLC today with the following steps:

- Step 1: Name your LLC

- Step 2: Establish Ownership of your LLC

- Step 3: Decide on a Registered Agent

- Step 4: File the Articles of Organization

- Step 5: Create your Operating Agreement

- Step 6: Register for an EIN

Step 1: Name Your North Dakota LLC

Before filing anything, you need to choose a name for your North Dakota LLC. Be aware that both state and federal regulations and restrictions exist concerning words that can/cannot be used in business names.

Tip: Use a free business name search tool to ensure your company’s desired name is available.

Business Name Guidelines

- The official name of your business must end with: Limited Liability Company, Limited Company, LLC, or L.L.C.

- Your business name cannot be intentionally misleading to consumers

- The name of your new LLC must not be similar to another organization’s name/trademark

Restrictions

- “Lottery” and “Bank” are ineligible for use (any state)

- Terms that represent educational or Veterans’ organizations are restricted

- Terms related to the Armed Forces or civil servants (police, EMT, fire)

LLC business names associated with government and/or financial entities are not always restricted - it depends on the state. Additional paperwork may be required.

URL Availability

In addition to choosing a name for your LLC, you should also decide on a domain name for your business website. Check website address availability at a number of online web services sites.

Step 2: Establish Ownership

The owners of an LLC are called members and managers. All LLCs will have members, but not every LLC will have managers — it depends on the management structure of the business.

LLC Management Structures:

- Member-managed: All members participate in operating and making decisions for the LLC

- Manager-managed: An appointed manager oversees the daily operations of the LLC and the members are not actively involved.

North Dakota LLC Member Guidelines

Required Number of Members

There must be at least one member or manager to form an LLC in North Dakota.

Member Disclosure Requirements

An organizer/authorized representative may sign and file the Articles of Organization in place of the LLC members.

Age Restrictions

LLC members in North Dakota may be of any age.

Residence Restrictions

There are no residency restrictions imposed on LLC members in North Dakota.

Step 3: Find a Registered Agent in North Dakota

Any business formed in North Dakota must select a registered agent. Your LLC is not in proper compliance without filling this position.

What is a registered agent?

A registered agent is a person or business who is authorized to accept official government and service of process notices for the LLC.

Why do you need a registered agent?

You are required by law to appoint a registered agent so that the state/federal government has a consistent contact person for your LLC.

What are the main requirements for a registered agent?

- The registered agent must have a physical address — not a P.O. Box

- The registered agent must be available during business hours

Who can be a registered agent in North Dakota?

- A state resident with a physical address in North Dakota

- An LLC or corporation that is licensed to conduct business in North Dakota

Is the registered agent’s contact information publicly accessible?

The name and contact information of the LLC’s registered agent is a matter of public record.

Can I be my own registered agent for my business?

You are legally allowed to be your own registered agent as long as you meet the requirements.

Is being my own registered agent discouraged?

Business owners who choose to be their own registered agent risk compromising their personal information.

Tip: Avoid the hassles and choose Swyft Filings to fill the registered agent needs for small businesses in North Dakota. Find more information here.

Step 4: File the Articles of Organization

Filing the Articles of Organization with the Secretary of State is necessary and vital in forming your North Dakota LLC.

What is the Articles of Organization?

The Articles of Organization is a legally binding document that is filed with the state government to officially and legally form your LLC.

What is the cost of filing the Articles of Organization?

The filing fee for North Dakota is $135.

Why do I need the Articles of Organization?

Your LLC business in North Dakota will not be legally recognized by the Secretary of State without this document.

What information is included in the Articles of Organization?

- The name and address of the LLC

- The effective date of the LLC

- The name of the organizer filing the paperwork

- The name and location of the registered agent

Additional North Dakota Filing Information — Professional LLCs

Certain professional service businesses to form a specific type of LLC in North Dakota known as a Professional Limited Liability Company (PLLC).

The following professions are allowed to form a PLLC:

- Accountants

- Attorneys

- Physicians/Medical Professionals

- Professional Counselors and Psychologists

- Architects and Engineers

- Veterinarians

- Social Workers

A few points to consider:

- All members of the PLLC must be licensed in the profession of the business.

- The PLLC is only allowed to provide services for which the business was formed.

- The members are still subject to whichever licensing boards govern the PLLC’s profession.

Step 5: Create an LLC Operating Agreement

An LLC Operating Agreement is an important document that ensures the long-term success of your North Dakota LLC.

What is an LLC Operating Agreement?

The LLC Operating Agreement is a legal document that defines the roles of the members/managers and lays out the details involving the business’s operating procedures.

Why do I need an LLC Operating Agreement?

The LLC Operating Agreement is a necessary part of the business because it provides structure, defines voting rights and earning disbursement, protects business assets, and reduces the potential for disputes.

Do I need to file the LLC Operating Agreement?

You do not need to file the Operating Agreement with the state; it is for the benefit of your LLC and remains in-house.

What goes into an LLC Operating Agreement?

For the most part, the LLC Operating Agreement will include the following information:

- List of the members/managers and their roles

- Designation of authority in the LLC

- Initial capital contributions of the members

- Voting designations and percentages of the members

- Member transfer/addition rules and restrictions

- Distribution of profits

- Meeting schedule

Tip: Get a customized LLC Operating Agreement for your small business with Swyft Filings. Add structure to your LLC now.

Step 6: Register for an EIN

Obtaining an EIN is a federal requirement for most businesses. Your North Dakota LLC will not be able to conduct business without this ID.

What is an EIN?

The EIN is a nine-digit number that is assigned to your business by the Internal Revenue Service (IRS). It is similar to a personal Social Security number as a federal identifier.

What does EIN stand for?

EIN is an acronym for Employer Identification Number. It is also known as a Federal Tax ID.

Are all businesses required to have an EIN?

Federal law dictates that certain types of business entities register for an EIN:

- Any business with employees (even if owned by one person)

- Any business with more than one member

- A partnership (LLC or C-corp)

Please Note: A sole proprietorship is not required to have an EIN, but it is still recommended.

Why does my LLC business need an EIN?

The more common reasons you would need an EIN are:

- To hire employees

- To open a bank account in the U.S.

- To file your company’s taxes

- To pay independent contractors

In short, if you make money through your business and it has employees, you must have an EIN.

Is the EIN publicly listed?

The EIN for your LLC will be part of public record.

Can I use my Social Security Number as the EIN?

You can elect to use your social security number; however, please remember that your EIN is part of public record.

Swyft Filings offers EIN services for small businesses in North Dakota. Find more information here.

Phase Two: Maintaining Your North Dakota LLC

You have completed the initial phase of setting up your North Dakota LLC and are now ready to move to the next phase of getting your business ready to operate:

- Step 1: Register for Taxes in North Dakota

- Step 2: Apply for Permits and Licenses

- Step 3: File the Annual Report

- Step 4: Request a Certificate of Good Standing

Step 1: Register for North Dakota State Taxes

North Dakota does not require LLCs to pay a corporate or franchise tax. LLC members are still required to pay state and federal income taxes on their earnings.

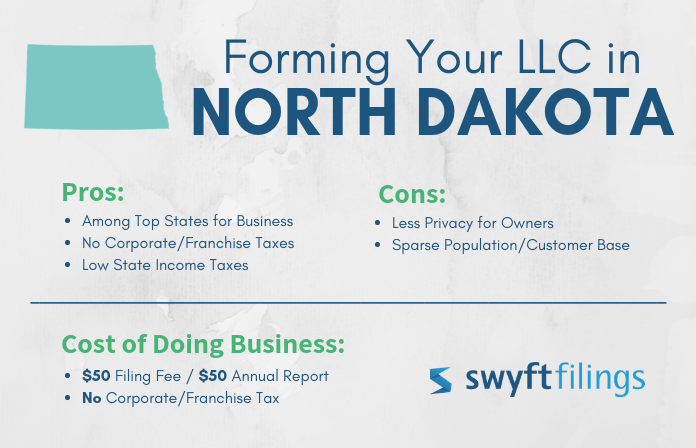

State Income Taxes

North Dakota’s state income tax rates are listed in the table below:

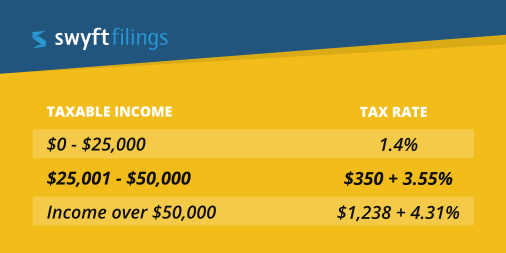

Corporate Tax Information

You can also choose to have your LLC taxed as a corporation; if so, you will be responsible for paying the corporate income tax rate on your business’s earnings. See the table below for tax rate information:

New Mexico’s state income tax rates are listed in the chart below:

Example Tax Breakdown ($150,000 Taxable Income): $350 + $888 + $4,310 = $5,548

Additional Tax Information

Other taxes your LLC may need to pay:

- Sales and Use Tax at 5%

- Employee Withholding Tax

- Unemployment Tax

Step 2: Obtain Business Licenses and Permits

The licenses and permits required for an LLC in North Dakota can vary, depending on a number of variables:

- Location (city and county)

- Type of Business

- Industry

Tip: If you would like to see more in-depth information on licenses and permits, please feel free to visit the content in our learning library that covers business licenses and permits.

Step 3: File an Annual Report

All businesses formed in North Dakota are required to file an annual report with the Secretary of State.

What is an annual report?

An annual report keeps your business’s information current with the state and is filed with the Secretary of State on a periodic basis.

What kind of information is in the annual report?

The information requested in the annual report is similar to what is in the Articles of Organization:

- The name and address of the business

- The name and address of the registered agent

- The names of the managers/members

- The business’s EIN

Is the annual report part of public record?

The annual report filed on behalf of your LLC is a matter of public record.

Fees and Due Date

Fee: $50

Due Date: Nov 15th

Frequency: Every year

Implications of Late Filings: $100 late fee

Swyft Filings helps you stay compliant by providing stress-free solutions. File your annual report with us today.

Step 4: Request a Certificate of Good Standing

After everything else for your North Dakota LLC is complete, the last step is to request a Certificate of Good Standing for your business.

What is a Certificate of Good Standing?

The Certificate of Good Standing is an official notification that publicly confirms your business is in compliance with all state regulations.

Who issues the Certificate of Good Standing?

The Certificate of Good Standing is issued by the Secretary of State.

When can I request a Certificate of Good Standing for my business?

Submit your request for a Certificate of Good Standing after your LLC is officially formed .

Why do I need a Certificate of Good Standing?

Having a Certificate of Good Standing adds a measure of credibility to your new LLC for banks, financial institutions, and other businesses. Some companies may not even agree to a business deal if your LLC does not have this certification.

Additionally, some states require a Certificate of Good Standing before a business can apply for Foreign Qualification.

Does the Certificate of Good Standing have an expiration date?

The Certificate of Good Standing does not expire/does not need to be renewed.

Swyft Filings can create a Certificate of Good Standing for your North Dakota LLC. Click here for more information.