Managing Your Business

What Does the Republican Tax Plan Mean for Small Business?

The Republican Party released the details of their Tax Cut and Jobs Act in 2017. Much of the focus has been on individual tax rates and the status of certain individual deductions. In addition, its supporters have touted how it is great for small businesses. When you look at the details, however, the plan is not as helpful to active small business owners as initially projected.

One of the primary benefits promoted by the GOP in the proposal is the reduction of the corporate tax rate from 35% to 20%. While that would help many small businesses with high profits, the bill included an important rule shrinking the benefit for moderately profitable small business owners.

How Does the Republican Tax Plan Affect Small Business Taxes?

The policy for this framework is to encourage small business ownership. Advocates argue small business owners are the ones creating jobs and growing the economy. Therefore, the small business owner is treated more favorably than the salaried individual who may make $500,000 in W-2 salary income. For example, the minimum salary for a rookie in the NBA is reportedly $543,000, but let's lower it to $500,000 for our example. Even under the Trump tax plan, the NBA rookie would pay 35% (as opposed to the current 39%) on that salary meaning he pays $175,000 -- $50,000 more than the small business owner. The supporters of the tax plan argue that our two small business owners would take their additional $100,000 in savings to hire more employees or expand their business thereby growing the economy.

While the Republican tax proposal certainly benefits the profitable small business, when the small business profits are more modest, the benefits are much less clear. For example, let's look at what happens if a business owner who made an S Corp election has profits of $75,000. Under the framework, this small business owner would also pay 25% on this pass-through income or $18,750 in taxes. Meanwhile, under existing tax laws, an individual who earns $75,000 is already in the 25% tax bracket so there would be no savings for this small business owner.

How Are Small Businesses Taxed Without the 2017 Bill?

To look at the projected benefits, let’s first look at the existing tax structure. If you are running a C Corp, then the company will pay less in taxes, leaving more to be distributed as profits to the owner or more for the company to invest in new hires or purchases. While the reduction of the corporate tax rate from 35% to 20% is the headline-grabber, and it is good news for many of the large publicly-traded companies, most small businesses did not pay the corporate tax rate.

Most small businesses, such as sole proprietorships, LPs, and LLCs, make an S Corp election so that the profits of the small business are only taxed once. Without the S Corp election, C Corps incur what is often called "double taxation" because the profits are taxed at the corporate level (35% currently and 20% proposed). When the profits are distributed to the owners, they are taxed again at the individual level. In contrast, there are no taxes on the profits of an S Corp at the corporate level. When those profits are passed through to the owners, they are only taxed once — at the individual level.

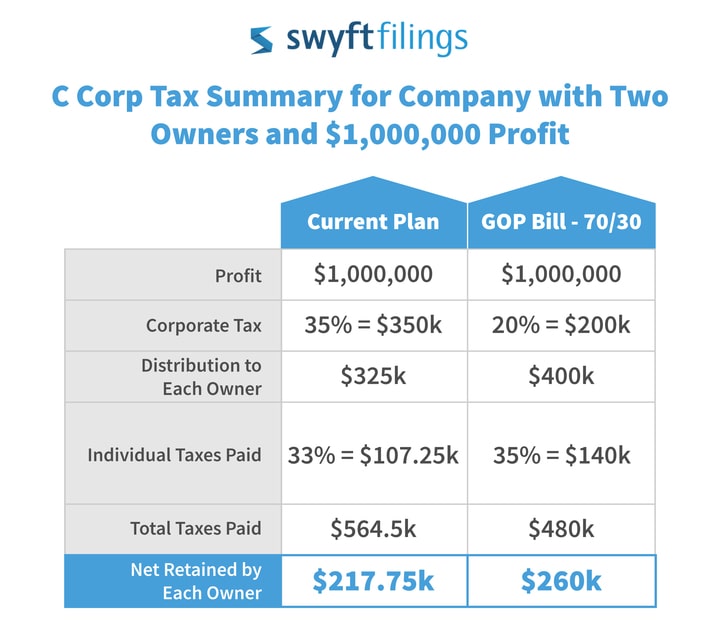

By way of example, without an S Corp election, if a company has two owners and has a profit of $1,000,000, then the corporation pays taxes on the $1,000,000. Under the current estimated corporate tax rate of 35%, $350,000 in taxes is paid by the company on the profits. Then, the remaining $650,000 is distributed to the two owners. The two owners would then pay tax on their share of the $325,000 at their taxable rate. The currently estimated tax bracket for a single person who earns $325,000 is 33%. So the owners, under this scenario, would each pay roughly another $100,000 in taxes at the individual level and net $217,750. *

Under the proposal, the two business owners would save quite a bit of money if they owned a C Corp because of the reduced corporate tax rate as shown below.

Therefore, if the tax plan passes, each owner of a C Corp would retain approximately $40,000 more.

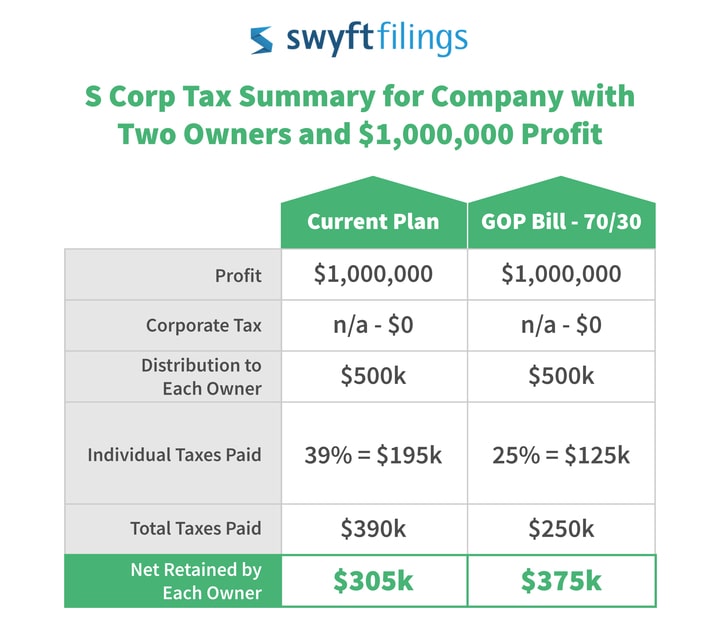

While there are savings for the C Corp owner in the proposal, conventional wisdom suggests the better plan for most small business owners is to take advantage of the S Corp election. With that, there is no tax at the corporate level on the $1,000,000. As a result, $500,000 is distributed to each owner. The owner is then taxed at the individual level for their $500,000. The current tax rate for single individuals earning $500,000 is roughly 39%, so each owner pays about $195,000 in taxes netting $305,000 or $325,000 under the proposed 35% tax bracket.* Both owners saved close to $100,000 more just by making their S Corp election under the current system as shown in the chart below.

Swyft Filings can help you with your S Corp election which you can do regardless of what happens with the proposed tax changes.

The Real Savings for Small Business Owners Who Make the S Corp Election

The talking points on the bill distributed by Republicans on the House Ways and Means Committee states:

Reduces the tax rate on the hard-earned business income of Main Street job creators to no more than 25% - the lowest tax rate on small business income since World War II.

That means the cap on the rate for the pass-through income for an LLC or partnership who has made an S Corp election would be 25% rather than whatever tax rate may apply to the individual business owner.

Let's see how that impacts our hypothetical profitable small business. Just like before, there is no tax at the corporate level, so both owners receive a distribution of profit of $500,000. Rather than taxing the owner at his individual tax rate of 39% (or the lower proposed 35%), the owners would be taxed at 25% for their pass-through income. That means each owner pays $125,000 in taxes and nets $375,000.* The savings to each owner are $50,000 totaling $100,000 for the company.

As you can see, the tax plan would save the S Corp business owner $70,000. By making an S Corp election under the new proposal, the business owner can save $115,000 compared to a C Corp business owner, even under the tax bill.

The policy for this framework is to encourage small business ownership. Advocates argue small business owners are the ones creating jobs and growing the economy. Therefore, the small business owner is treated more favorably than the salaried individual who may make $500,000 in W-2 salary income. For example, the minimum salary for a rookie in the NBA is reportedly $543,000 (but let's lower it to $500,000 for our example). Even under the Trump tax plan, the NBA rookie would pay 35% (as opposed to the current 39%) on that salary, meaning he pays $175,000 — $50,000 more than the small business owner. The supporters of the tax plan argue that our two small business owners would take their additional $100,000 in savings to hire more employees or expand their business, thereby growing the economy.

But Wait, There Are Important Exclusions

You would think small business organizations would fully support this plan. But you may have read by now that support from small business organizations is tepid at best. That’s because of certain exclusions that would cover many small businesses.

The architects of the initial bill were concerned people would take advantage of the new rules. Instead of being the employee of a law firm, doctor’s office, or other professional groups, for instance, individuals might instead become single-member LLCs. By doing this, they would receive all their income that was previously salary as LLCs earnings, and therefore taxed at the reduced rate.

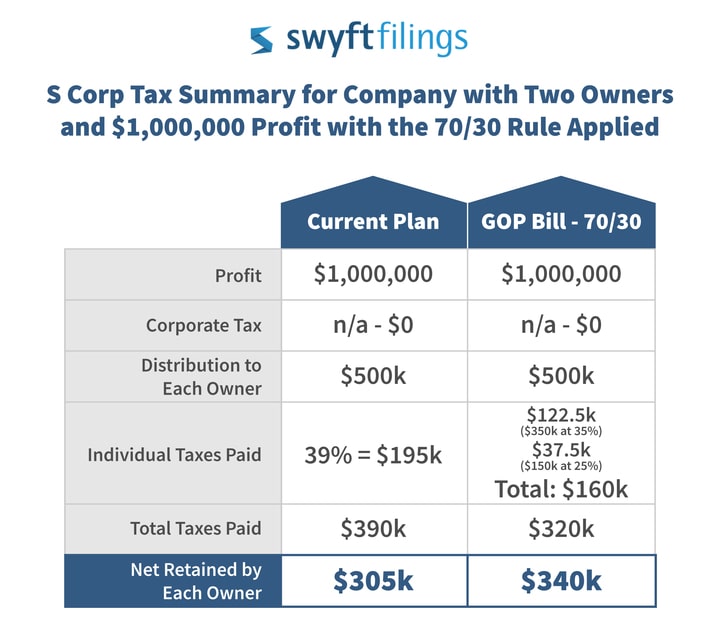

To address this, the bill introduced a “70/30 rule” that has not yet been discussed much. This rule would mandate that business owners who are actively involved in their business as their primary employment would have to treat at least 70% of their income as salary. This would mean they could only designate 30% percent of their income to be subject to the 25% pass-through rate.

While addressed to counter tax avoidance issues, it would cover many of the small businesses that actually hire people and provide goods and services the reform is supposed to promote. Instead, this exclusion would benefit passive owners of real estate investment-type LLCs as opposed to small manufacturers, retailers, or online service providers. Here is the same analysis with the 70/30 rule applied:

That rule could result in some legitimate businesses, such as manufacturers, not getting the full benefit of the reduction. There are already rules in place that prevent active business owners from classifying all their income as “distributions” as opposed to salary, such as the requirement that active business owners are to receive reasonable salaries. The proposal does allow a taxpayer to argue its way out of the 70/30 rule, but the myriad rules counter-balances the efforts to simplify the tax code.

In addition to the 70/30 Rules, the benefit of the proposal diminishes as the profitability of the small business diminishes. For example, let's look at what happens if a business owner who made an S Corp election has profits of $100,000. Under the bill, this small business owner would also pay just 25% on this pass-through income based on the revised tax brackets. While there may be savings for this business owner based on some of the other provisions, there is no benefit from the cap on the pass-through income at 25%. In fact, the proposed 25% tax bracket goes up to $260,000, so a business owner would not see a benefit on the cap for pass-through income until the profits exceed $260,000.

* The tax estimates are rough estimates because it is much more complex than simply applying a percentage to a total amount because it excludes any deductions and the tax brackets are staggered. The proposal would lower the rate for people earning between $260,000 and $1,000,000 from 39% to 35%, so there would be some savings under the proposal even if the portion reducing business income doesn’t pass, but the new tax rates do.